Sometimes I would like to predict how my performance from long-term investments will change when I customize my portfolio.

So, I created the "Asset Allocation Simulator" using HTML and Javascript.

This tool works only in the client environment and no data is sent to an external server.

I would like you to check the overview of this tool, and use it in accordance with the usage.

What is this tool?

I created the "Asset Allocation Simulator" which you can customize for yourself.

Using this tool, you can simulate your performance from long-term investments based on your portfolio.

In addition, as the following field, I was prepared for five assets as your portfolio which you can customize.

Five assets you can customize

- Domestic bonds

- Domestic stocks

- Advanced country bonds

- Advanced country stocks

- Emerging economy stocks

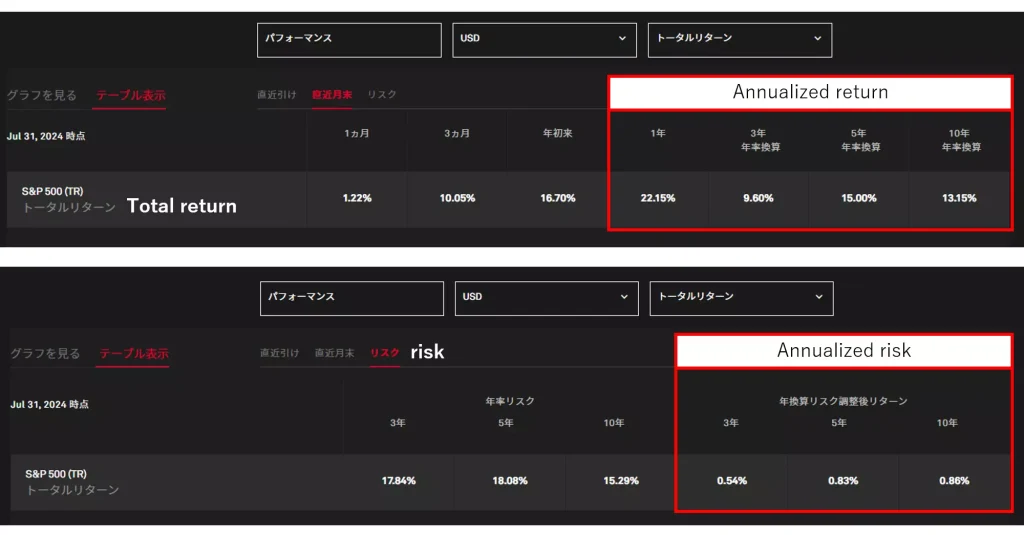

On the other hand, you need to being prepared for the pair of "return" and "risk" for each asset to use this tool.

So, I would like you to survey the latest "return" and "risk" in advance.

For example, I can collect these information for S&P500 from this link.

Asset allocation simulator

The concrete tool is shown below.

Caution

- The tool conducts simulations based on the assumption that the “continuously compounded rate of return is normally distributed".

- I would like to explain the mathematical background, but due to my poor English skills, I will spare you the details.

- The results of this simulation are NOT a guarantee of future investment results.

In this tool, bonus investment function which conducts investment in June and December is implemented.

If you cannot use this tool, please reload this page.

How to use this tool?

In this section, I will explain how to use this tool.

It consists of three parts and these parts are shown below.

| Part | Overview |

|---|---|

| Basic setting | Set up the input information such as monthly investment, reserved period, or fees etc. |

| Set up various assets | Set up each asset allocation and correlation coefficient for them. |

| Performance from long-term investments | Show the simulation results based on your portfolio. |

For each part, the concrete setting is the following.

I recommend using this tool on the PC site because the mobile site is very difficult to operate it.

Basic setting

In this part, I would like you to set up the input information such as principal, total monthly investment, and so on.

You need to recognize that the processing time increases with the length of the reserve period.

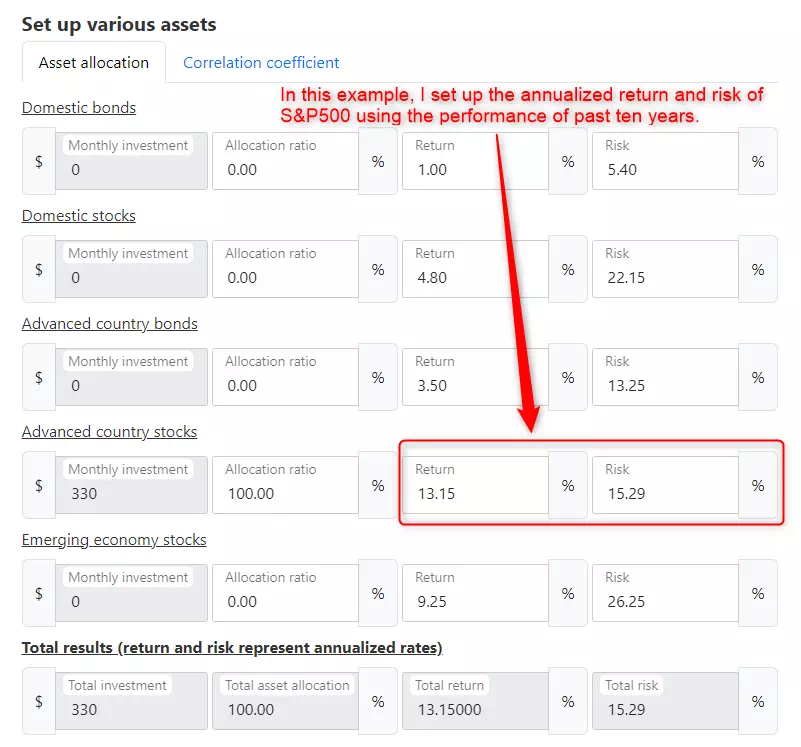

Set up various assets

In this part, you can customize the asset allocation based on your portfolio.

In this example, I set up the allocation ratio of advanced country stocks to 100%, the return to 13.15%, and the risk to 15.29% based on the past performance of S&P500.

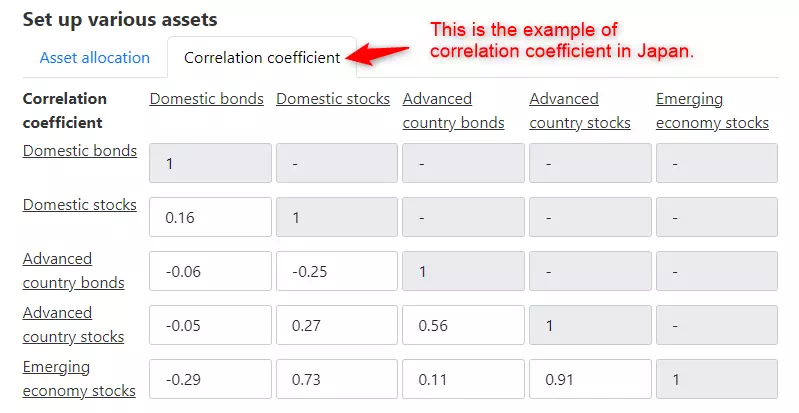

In addition, you can change the correlation coefficient for each asset.

In this example, I decided that I didn't have to change the correlation coefficient because I wanted to estimate the performance in Japan.

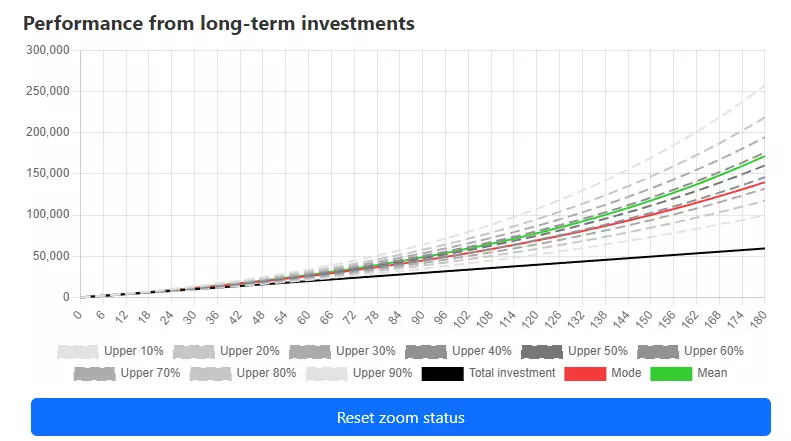

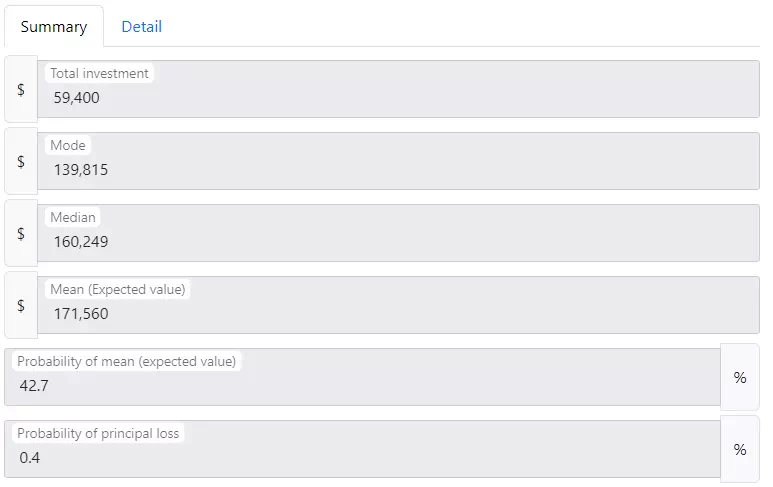

Performance from long-term investments

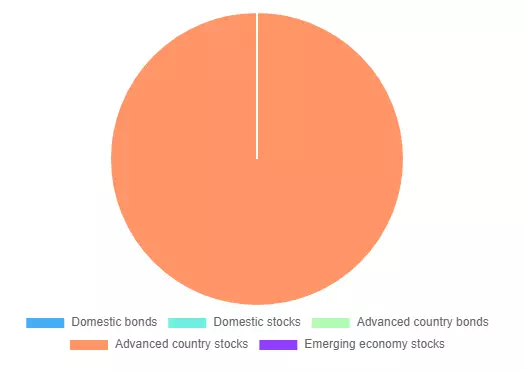

After setting each item, you can get the pie chart of your asset allocation.

In addition, the simulation result is shown by the line graph.

In the line graph and scatter graph, you can expand and move this graph using the following operations.

| Operation | Overview |

|---|---|

| Hold down the ctrl button and mouse scroll | Expand the graph |

| Drag and drop | Expand the selected area of the graph |

| Hold down the ctrl button and drag | Move the graph |

| Click the reset button | Reset zoom status |

Moreover, you can check the performance in detail.

Conclusion

In this article, I explained the following contents.

Contents of this article

Using this tool, you can conduct simulation for your portfolio and you can also update it based on the simulation result.

Please use this information as a reference to obtain information for future asset building.

This article is not intended as a guarantee of investment returns, a solicitation of specific products, or a recommendation to buy or sell.

Final investment or contract decisions are the sole responsibility of the individual.